Contents

Credit Unions and Bankruptcy in Michigan

Many of my clients love their credit unions. There are pros and cons to keeping your credit union after filing bankruptcy. Let my office help you make an informed decision before you file.

The first thing I do when a client tells me that they want to keep their credit union out of the bankruptcy is to look and see how much debt they have with the credit union, to determine if reaffirming the debt or keeping it after the bankruptcy makes sense. If the amount is small, such as a $300 overdraft account associated with their checking account I’ll generally agree that the benefits of keeping or “reaffirming” the debt do make sense. Most credit unions will allow members to retain all membership privileges as if they had never filed bankruptcy after the member reaffirms the debt in bankruptcy. If, however, the credit union debt amounts to thousands of dollars in loans or credit card obligations, I will generally counsel my clients to include the debt in the bankruptcy and discharge it. This is ultimately my clients own decision. My job as their bankruptcy attorney and counselor is to advise my clients of all options available to them and help them make an informed decision weighing the pros and cons of each.

Credit Unions have a right to “SET-OFF”. What does that mean if you are filing bankruptcy?

Credit Unions and some banks will sometimes “Freeze” your checking or savings account upon notice of your bankruptcy filing if you owe them money.

discharge or wipe-out in your bankruptcy as well as debts that are non-dischargeable as a matter of law such as child support and alimony. The law also requires you to list debts you may wish to keep like your car loan or mortgage and yes, even your credit union loans. When I am preparing a bankruptcy petition for one of my clients and I see that they owe a debt to a credit union, I ask them what they want to do. If the client wants to wipe out the debt, I counsel them to close their credit union account. Why, because the credit union will “set-off” once they receive notice of the bankruptcy. The way it works is this. The credit union will receive a bankruptcy notice from the bankruptcy court, informing them that you filed a bankruptcy. They will immediately look to see if you have any funds on deposit at their institution. If you do, they will place a “hold” on the account and freeze the funds. This can cause problems such as NSF or bounced checks, unpaid automatic withdrawals to pay other accounts such as your mortgage or car note. If you wish to keep the debt you owe the credit union, my office will contact the credit union and inform them that you intend to reaffirm the debt, and they will usually release the hold. Should you wish to wipe-out or discharge the debt, you must close your credit union or withdraw as much as possible from the account before filing bankruptcy, otherwise the credit union can keep whatever amount is in the account on the day of filing up to the amount you owe them. A good rule of thumb is that if you are causing the credit union a monetary loss through a bankruptcy filing, take your business elsewhere. Unlike a bank, where you are an account holder or customer, you are a “member” of the credit union. When a member causes a loss to the other members due to a bankruptcy filing, the credit union will terminate the membership unless the debt is reaffirmed. If the amount of the debt is high, the best thing to do may be to simply open another account at another bank or credit union to which you don’t owe any money before filing.

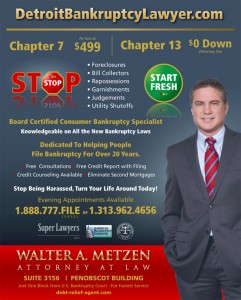

Let Detroit Bankruptcy Attorney, Walter Metzen, help you get that Fresh Start you deserve!

Detroit Michigan Bankruptcy Attorney Walter Metzen is a board certified consumer bankruptcy specialist practicing in the Detroit bankruptcy court which covers 9 counties in Metro Detroit.

I am a Board Certified, highly experienced Detroit Michigan Bankruptcy Attorney. I have filed over 20,000 cases in the Detroit Bankruptcy Court. At my office, you will not meet with a legal assistant and we offer same day appointments. I offer free consultations to determine whether bankruptcy is the right option for you, and if so, I specialize in both Chapter 7 and Chapter 13 bankruptcy cases in Michigan. Call today and get your questions answered by an experienced bankruptcy attorney who understands the financial pressures you are facing.