If you live in metro Detroit and are filing a bankruptcy petition, it will be filed in the Detroit Bankruptcy Court located at 211 West Fort Street in Detroit, Michigan. Bankruptcy is Federal law, and is uniform throughout the United States. Unlike State of Michigan Courts, there are not many bankruptcy Courts. The Bankruptcy Court for the Eastern District of Michigan handles the filings for those residents of Wayne, Oakland, Macomb, St. Clair, Sanilac and Lenawee Counties. The State of Michigan is divided into two districts for bankruptcy filing purposes, the Eastern District and the Western District. The Eastern District is headquartered in Detroit whereas the Western District is headquartered in Grand Rapids. Every consumer bankruptcy case that is filed in the country will be assigned a bankruptcy trustee.

What is a Chapter 7 Trustee?

Bankruptcy law is also often referred to as Debtor/Creditor law and basically involves the interplay between creditors, who are owed money by a debtor, who is the person or married couple (debtors) who owe the debt. When a consumer bankruptcy case is filed, the person filing the case is the debtor. The bankruptcy system will appoint a bankruptcy trustee to administer the bankruptcy case. The trustee is randomly assigned from a pool of available Trustees and they will conduct what is called the Meeting of Creditors or the Section 341 Meeting as it is referred to in the bankruptcy code. In the Detroit bankruptcy court, there are presently twelve Chapter 7 trustees who could possibly be assigned to your case. Their job is to investigate your financial affairs, examine you under oath and determine if you have any assets that are not protected by your available bankruptcy exemptions, and if so, sell those assets to generate money to pay your creditors. All of your assets must be disclosed in the bankruptcy petition that is filed when you commence a bankruptcy case. Certain assets are more likely to be subject to liquidation by the Chapter 7 Trustee than others. It is important to understand that a Chapter 7 bankruptcy trustee’s job, his or her fiduciary duty, is not to look out for your best interests, but to look out for the best interests of your creditors. Debtor/Creditor law is adversarial in nature. Each side has a competing interest. Your trustee is your adversary when a bankruptcy is filed, their duty is to the creditors in your case. The trustees in the Detroit bankruptcy court are all highly skilled professionals at liquidating assets and recovering certain pre-bankruptcy transfers for the benefit of your creditors. All of them are attorneys, and they also have a team of attorneys, oftentimes in their own law firm, who represent them. This is why you need to hire an experienced bankruptcy attorney and one who is familiar with the trustees in the district in which your bankruptcy case is filed. A Chapter 7 Trustee’s job is markedly different than the job of the United States Trustee whose primary task is to oversee the bankruptcy process.

I have been practicing nothing but consumer bankruptcy law in the Detroit bankruptcy court for my entire career of nearly 30 years. Naturally, I have come to know all of the bankruptcy trustees very well, and have a good working relationship with them. I have known some of them since they were appointed to their positions as trustees and, unfortunately, over the years, some of them that were my close colleagues passed away during the last few years. All of them earned my respect after working on thousands of consumer bankruptcy cases with them.

In a Chapter 7 bankruptcy case, the benefit of a bankruptcy Discharge granted by a Federal Bankruptcy Judge often outweighs the value of any non-exempt assets.

When I am retained to file a Chapter 7 bankruptcy case, the goal for all of my clients is to be granted a bankruptcy Discharge or Court Order that prohibits your creditors from ever attempting to collect the debt you owe them. At the same time, I closely examine your financial affairs and the property you own as well as other assets and use available Federal or State of Michigan bankruptcy exemption laws to shield those assets from the trustee, to the extent allowed by law. Fortunately, in the vast majority of bankruptcy cases I handle, upward of 95% are no asset cases, meaning there are no assets available for the trustee to sell for the benefit of creditors, above those amounts that are protected by applicable bankruptcy exemption laws. In these cases, the Trustee will abandon the assets in which case they revert back to the debtor. In Michigan, we are fortunate to be able to choose from either the Federal or the State exemptions both of which allow you to protect certain assets, up to a certain amount, as the basis of your fresh financial start. Exemption laws are quite complex and only an experienced bankruptcy attorney should provide legal advice on how to best utilize them for your particular case.

In the roughly 5% of consumer Chapter 7 bankruptcy cases that my office handles that are asset cases, debtors have some asset that cannot be entirely protected with the applicable bankruptcy exemptions. This causes the case to became a bit more complicated and it will likely take a number of months longer for the case to close and work it’s way through the bankruptcy system. This is because the trustee needs to notify the creditors that assets are available in the case and then examine what is called the creditors “Proof of Claim” which is a form filled out by the creditor which basically proves to the trustee that they did have a valid claim in the bankruptcy estate, and then of course to eventually pay the claims their pro-rata based on their classification and other claim amounts that come in. All of this takes time, but the bankruptcy judge will nevertheless grant the Discharge Order typically three months after the bankruptcy case is filed, even if there are assets yet to administer. Due to careful pre-bankruptcy filing analysis, my clients usually know before the case is filed that their Chapter 7 will be an asset case and then make the informed decision to go forward and file the case understanding that the value of the asset they will surrender to the trustee is far less than the amount of the debt they have that will be discharged by the bankruptcy court. In other words, the benefits of filing are outweighed by any potential loss of assets. Remember, bankruptcy is debtor/creditor law. There is a tug of war between the creditors and you, the debtor. The bankruptcy exemption laws clearly define what assets you can keep for your fresh start. Those assets that are not exempt are to be administered by the trustee for the benefit of your creditors. Bankruptcy law is meant to be a fair and equitable exchange in which you agree to surrender your non-exempt assets in exchange for a bankruptcy discharge. In the thousands of bankruptcy debtors I have represented in my career, in all of the cases, including those cases that were asset cases, my clients had thousands of dollars in debt wiped out and were granted a fresh financial start. For further reading on the topic of protecting assets in a Michigan bankruptcy case, read my blog post about Protecting Trust Assets in a Michigan Chapter 7 Bankruptcy.

Let’s talk a bit more about what is referred to in bankruptcy attorney speak as non-exempt assets and surrendering those to the trustee. In reality, a bankruptcy debtor’s asset is hardly ever “surrendered” or physically handed over to the trustee, because the trustee doesn’t want to take possession of your non-exempt motorcycle, boat or camper. Trustee’s want assets that are easily transferable and liquidated to cash to be available to creditors. Trustee’s favorite assets are non-exempt tax refunds, bank accounts, possible personal injury awards or settlements, etc. Our Detroit trustees are much more likely to take a reasonable discounted cash offer rather than incur significant costs in picking up, storing and auctioning off that boat, RV or motorcycle. It pays to have an attorney who is experienced in negotiating with our local trustees when it comes to a Chapter 7 bankruptcy case in which there are unprotected assets.

One of the most challenging aspects of a consumer bankruptcy Chapter 7 case is a case in which real estate, most commonly a personal residence is part of the bankruptcy estate. Real estate can be difficult to accurately value as the market is always changing and prices are influenced by so many different forces such as the economy, mortgage interest rates, and even the time of year. There are certain tools available which are used by the trustee’s such as online estimates of real estate such as Zillow.com or Realtor.com and the state equalized valuation by the local property taxing authority can be useful when attempting to determine value. Sometimes the trustee will hire a real estate professional to take a look at the property to get their opinion act to the present fair market value to help them determine whether they agree with the value as listed in the debtor’s bankruptcy schedules. Occasionally, a trustee will dispute the value a debtor has placed on their real estate and believes that there is equity in the property above what can be exempted. Most trustees do not want to sell a debtor’s home to fulfill their duty to creditors and are generally willing to accept a reasonable offer to pay the bankruptcy estate the value of the non-exempt equity. Again, an experienced Michigan bankruptcy attorney can help you should this occur in your Chapter 7 bankruptcy case.

For more information on real estate and the bankruptcy trustee, see my blog post on Will I Lose My House in Chapter 7 Bankruptcy?

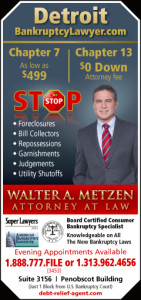

I am a Board Certified, highly experienced Detroit Michigan Bankruptcy Attorney. I have filed over 20,000 cases in the Detroit Bankruptcy Court. At my office, you will not meet with a legal assistant and we offer same day appointments. I offer free consultations to determine whether bankruptcy is the right option for you, and if so, I specialize in both Chapter 7 and Chapter 13 bankruptcy cases in Michigan. Call today and get your questions answered by an experienced bankruptcy attorney who understands the financial pressures you are facing.

My goal is to provide you with honest legal advice to allow you to make an informed decision as to how best to deal with your creditors and if bankruptcy is an option, which Chapter might be the best option for you.