Contents

- Chapter 7

- Chapter 13

- So, which Bankruptcy Chapter Is Right for Me? Chapter 7 or Chapter 13?

- CHAPTER 7 VS. CHAPTER 13 BANKRUPTCY: AN ANALYSIS

- THE CHAPTER 7 BANKRUPTCY MEANS TEST

- THE PRESUMPTION OF ABUSE TEST IN CHAPTER 7 BANKRUPTCY

- CHAPTER 13 BANKRUPTCY: COST-BENEFIT CONSIDERATIONS

- CHAPTER 13 VS. CHAPTER 7 BANKRUPTCY: THE BOTTOM LINE

My goal is to provide you with honest legal advice to allow you to make an informed decision as to how best to deal with your creditors and if bankruptcy is an option, which Chapter might be the best option for you.

Chapter 7

For the average consumer, there are basically these two chapters available. Chapter 7 is the most common and in the typical case, you (and your spouse if you are married and file jointly) will keep all of your property while wiping out (getting a court ordered discharge) of most of your debt (credit cards, medical and utility bills, past balances from car repossessions or home foreclosures). You can’t wipe out child support/alimony, recent income taxes and usually student loans. When I say that you will keep your property, I mean in a typical Chapter 7 bankruptcy case in Michigan in which I am your bankruptcy attorney. This is because my office will diligently look into your particular financial circumstances and with the help of the bankruptcy exemption laws, protect your assets from being sold to pay your creditors. Only after a thorough evaluation between you and your bankruptcy attorney should you go forward with a Chapter 7 bankruptcy filing. I have seen people who have filed on their own or with an inexperienced attorney who dabbles in bankruptcy lose their entire life savings! When my office evaluates your case, you will know that you are safe and will not lose anything or, you will know exactly what property you might have that is not protected and will be advised on how to go forward. In 30+ years and over 20,000 bankruptcy cases filed for metro Detroit people, I have never had a client who lost something to the trustee that they did not know beforehand and usually we were able to simply settle with the trustee and pay the fair market value of the property if my clients wanted to keep it. You have to “qualify” for Chapter 7 meaning that you must show that after you pay your reasonable monthly living expenses, you have no money left over to pay your creditors and you wish to wipe them out.

Chapter 13

Chapter 13 bankruptcy is also called a reorganization and is basically a repayment plan. A Chapter 13 petition is usually filed if you are trying to save a home from foreclosure or a tax sale or you have some money left over every month but not enough to pay all of your creditors the amount they are demanding. Sometimes my clients will choose to file a Chapter 13 to protect an asset or some other property that may be subject to a trustee sale if the case were a Chapter 7, other times they choose to file a Chapter 13 because they simply make too much money to qualify for a Chapter 7 and still will get significant financial relief through a Chapter 13 discharge. In a Chapter 13, none of your property can be sold by the trustee to pay your creditors, you simply pay the value of that property over time in the Chapter 13. The typical Chapter 13 repayment plan is 3 to 5 years. A lot can happen during a 3 to 5 year bankruptcy case such as needing to purchase or lease a new vehicle, or having additional members to the household, unexpected home or automobile repair expenses. We can help you navigate through these changes during the course of your Chapter 13 bankruptcy to reduce payments if needed or in some cases such as a reduction in income, job change or job loss, convert your case to a Chapter 7 bankruptcy. For more information

The proper Chapter to choose should only be made after a thorough evaluation with an experienced bankruptcy attorney. I am a Board Certified Specialist in Consumer Bankruptcy in Southeast Michigan with over 28 years of experience and over 20,000 happy clients served.

So, which Bankruptcy Chapter Is Right for Me? Chapter 7 or Chapter 13?

The question of whether a Chapter 7 bankruptcy or a Chapter 13 bankruptcy is best is likely the #1 question that a person carries with them into an initial consultation appointment with a bankruptcy attorney.

The correct answer to the question is to refrain from asking it until that consultation appointment. The bankruptcy attorney you meet with will gather a fair amount of key information from you very quickly to ascertain whether a Chapter 7 or Chapter 13 bankruptcy is not only right for you—but available at all.

A Chapter 7 bankruptcy often feels right as it is a process that does not require that you repay anything to your creditors.

However, would it still feel right if you were to learn that, if you were to file a Chapter 7, these things below will also happen?

- Your grandmother is sued for the recovery of the $1,000 you repaid her on a personal loan a year ago;

- Your small business has the vehicles or other assets seized as fraudulent transfers;

- Your non-filing spouse is sued for half the value of your home because you refinanced it in the spouse’s name 9 months ago;

- The Catholic school to which you prepaid a year’s worth of your child’s tuition is sued for recovery of the funds;

- Your adult child is sued for the turnover of the vehicle she is driving with your name on the title;

- You file and are protected by the “automatic stay against collections” injunction upon filing, but your mother who cosigned for your largest credit card is then sued for collections …

… and so on.

Perhaps, because of a short-term disability layoff form work, your income is currently low enough to “qualify” you for Chapter 7 but you know that you intend to return to work within the year.

Is Chapter 7 or Chapter 13 more appropriate in that circumstance?

Perhaps one of your more significant debts is a property settlement obligation arising from a State of Michigan divorce judgment.

Is Chapter 7 or Chapter 13 bankruptcy more appropriate?

The point is that there are many variables involved in a conclusion that a Chapter 7 or Chapter 13 bankruptcy is the best step forward to your fresh start.

All of those variables need to be reviewed with an experienced Michigan bankruptcy attorney to be properly analyzed.

That said, below is the sort of the roadmap that bankruptcy attorneys use—instinctually and not literally (unless they are very new and inexperienced bankruptcy attorneys)—to determine whether Chapter 7 or Chapter 13 bankruptcy is more appropriate for a given client.

CHAPTER 7 VS. CHAPTER 13 BANKRUPTCY: AN ANALYSIS

-

Are You Eligible for Chapter 7?

The first factor to be considered is whether you even have the option of filing for Chapter 7. There are not 1 but 2 income-based “tests” that you must pass in order to file for Chapter 7 bankruptcy.

THE CHAPTER 7 BANKRUPTCY MEANS TEST

The first is the well-known and unfortunate Bankruptcy Means Test.

This “test” is a mathematical formula inserted into the Bankruptcy Code in 2005 by a bipartisan group of politicians under the influence of financial services lobbyists whose own clients will make (marginally) more money if you file for Chapter 13 rather than Chapter 7 bankruptcy.

It essentially looks at the gross (pre-tax and other deduction) income of everyone in your household whether they are filing the Chapter 7 jointly with you or not for the 6 months prior to the month in which you file your Chapter 7.

That income is averaged up, multiplied by 12 (months) to arrive at what the Means Test thinks is your annual household income.

This number is then compared to the median income average for a household of your size. If you’re over the average, you may be required to file a Chapter 13 bankruptcy. (Or, if you refuse, file no bankruptcy at all.)

Why “may need to file” rather than “must?”

What is described above is what quickie online definition or faulty online “Means Test calculators” will tell you is the “Means Test.”

In fact, it describes only Part 1 of the Means Test. If you are over the median household income, an experienced bankruptcy attorney will need to then review your average monthly income, your state of current employment, and other information to then deduct some of that gross income back out of your Means Test “current monthly income” (average income).

If enough can be legitimately deducted out, you may yet be eligible for a Chapter 7 bankruptcy.

Why do you need a bankruptcy lawyer for this?

A well-heeled bankruptcy aphorism is that “all bankruptcy is local.” Yes, it’s a Federal legal process—but what have your local Bankruptcy Court judges determined is a proper “additional” food and housing deduction? What has the Federal Court of Appeals in which you reside had to say about it? Do you qualify for the business or military service exemptions? Do you have any income which can be deducted as a “special circumstance” deduction per the US Supreme Court’s ruling in Hamilton v Lanning?

Etcetera.

THE PRESUMPTION OF ABUSE TEST IN CHAPTER 7 BANKRUPTCY

So you cleared the “Means Test,” are you now eligible for Chapter 7 bankruptcy?

There is another hurdle: the “good faith” or “presumption of abuse” standard. This is an additional income-based test, pre-dating the Means Test and which did not vanish from the Bankruptcy Code in 2005 when Congress added the newer test.

Essentially, this is a scrutinizing of the “net” monthly average income “left over” at the bottom of the Schedule J list of average monthly household expenses. The sum total of these expenses are, on this Schedule, deducted from the average monthly household income (take-home pay) on Schedule I.

If there is “too much” income left over, it looks as though you can afford to make some kind of a payment in a Chapter 13 bankruptcy.

If you file for Chapter 7 with “too much” net income at the bottom of your Schedule J, you run a very good risk of your local US Trustee—the “gate-keeper” of Chapter 7 eligibility—filing a Motion to Dismiss your Chapter 7 case unless you agree to convert to Chapter 13 bankruptcy.

How much is “too much?”

This needs to be discussed with an experienced bankruptcy attorney, who will, among other things, be able to tell you whether the Catholic School tuition you’re paying every month for your cousin’s nephew is something you can list in the first place.

At the end of the day, the important takeaway is this: you can pass the Means Test and still fail this second “good faith” test.

The most common example of a situation in which this phenomenon arises is an adult-age recent college graduate who leaves campus with a degree, can’t find a job, and ends up moving back home to off of Mom and Dad’s good graces while working at Starbucks.

Low income = Means Test passage. Living at home = No expenses—and Chapter 13.

-

Will Chapter 7 Even Help You With Your Particular Debts?

Chapter 7 bankruptcy is not the best form of bankruptcy for all sorts of debt.

If a large portion of your debt arises from a divorce judgment, Chapter 7 will not help you. Both property settlement and support obligations arising from a Michigan divorce judgment are non-dischargeable in Chapter 7 bankruptcy. (Support obligations are non-dischargeable in any form of bankruptcy.)

If a large portion of your debt is non-dischargeable Federal or Michigan State tax debt, Chapter 7 cannot assist you with this. The IRS will simply resume its collection efforts upon completion of the Chapter 7 process, perhaps with penalties.

If you’re considering filing for bankruptcy because a foreclosure sheriff’s sale has been scheduled due to delinquent mortgage payments, Chapter 7 bankruptcy will only help you if you’re ready to walk away from the home. If you want to keep it, only a Chapter 13 bankruptcy can help you.

If the reason you’re considering filing for bankruptcy is due to student loan debt collections, it is possible that Chapter 7 may help you—but unlikely. This is certainly something to discuss with a (very experienced) bankruptcy lawyer with plenty of litigation experience.

The 6th Circuit Court of Appeals, in which Michigan rests, follows the onerous Brunner Test in determining whether a student loan may be discharged in bankruptcy.

If you have any income at all and are not disabled, odds are good that you will fail the Brunner Test. Again, as with (recent) tax debts, your student loan creditors will simply resume collections (plus accrued interest) upon completion of your Chapter 7 case.

There are further examples of the occasional ineffectiveness of Chapter 7 bankruptcy. Again, the effectiveness of the process is something to discuss with your bankruptcy lawyer.

-

Will You Lose Property If You File Chapter 7?

Chapter 7 bankruptcy is a liquidation bankruptcy.

It is possible to interpret this as meaning (correctly) that, in Chapter 7 bankruptcy, debts are “liquidated” and not required to be repaid, with exceptions as noted above.

What it really means is that, in a Chapter 7 bankruptcy, the assets of the debtor are available for seizure and liquidation by an individual known as a Chapter 7 Trustee if they are not fully “exemption” in the bankruptcy petition drafted by your lawyer with information you have provided.

“Exemption” is synonymous with “protection.”

Everything you own or have a claim to must be listed in the appropriate sections of your bankruptcy petition and assigned an accurate, good faith, fair-market value.

Property in your possession may be “exempted” from the “bankruptcy estate” created legally with the filing of the bankruptcy case over which the Chapter 7 Trustee exercises jurisdiction.

The “exemptions” are statutory language from either the US Bankruptcy Code or Michigan statute that allow you to remove certain types of property up to certain dollar-value amounts from the bankruptcy estate. If the value of the exemption used exceeds the fair-market value of the property, it has been fully exempted and fully removed from the estate.

Fully exempted property is thus outside the jurisdiction and seizure authority of the Chapter 7 Trustee.

However, the exemptions vary from property type to property type in value, and some types of property have no specific exemption to protect it at all.

Your comic book collection is one example.

The small business you own or have an interest in is another.

Further, as noted in the introductory paragraphs, above, the Chapter 7 Trustee has other powers for which no “exemption” protection is available: the unwinding of “fraudulent” transfers and “preference payments.” See “Will Your Chapter 7 Filing Hurt Someone You Care About?” (below).

-

Will Your Chapter 7 Filing Hurt Someone You Care About?

As noted above, the actions you may have taken in terms of asset or cash transfers as long as 10 years prior to the filing of a bankruptcy case will be reviewed for fraud or other indicia of “bad faith.”

Debts you repay to family members or other “insiders” over $600 within a year of the Chapter 7 filing date can be recovered by the Chapter 7 Trustee.

Property or cash transferred for “less than equivalent value” (i.e., that real estate you quitclaim to your nephew for $1.00 or the car titled to you that your sister-in-law is using and driving) can be recovered by the Chapter 7 Trustee as a fraudulent transfer going back as far as 6 years, under Michigan law.

When you have used your small business as a personal checking account or have transferred assets to your corporation, LLC, or trust entity to shield it from creditors, the Chapter 7 Trustee will be able to pursue it.

If the small business you operate has tangible assets, cash reserves, or collectible receivables, the Chapter 7 Trustee will be able to stand in your shoes and operate or spin the business down into cash to the extent of your own legal ability to do so.

If someone you care about has co-signed a dischargeable debt for you, your Chapter 7 will leave them holding all of the liability and will not shield your co-signor from collections. (In a Chapter 13 bankruptcy, individual co-debtors are shielded—for the duration of the 3-5-year Chapter 13 process.)

A Chapter 7 Trustee can cast a wide net, in other words. It may be that you have no choice but to proceed. It may even be that you don’t, in fact, care about these outcomes affecting other people or entities.

They are, however, certainly things that you must understand in advance of deciding to proceed with a Chapter 7 filing, and they are things that you will only understand after a proper consultation with an experienced bankruptcy attorney.

-

Is Chapter 13 Bankruptcy Better for You?

This article has focused, thus far, primarily on Chapter 7 bankruptcy and some of the pitfalls associated with that process.

Chapter 13 bankruptcy carries its own points of consideration.

CHAPTER 13 BANKRUPTCY: COST-BENEFIT CONSIDERATIONS

The first is whether or not it is “too much bankruptcy” for you. That is, whether the cost of the Chapter 13 bankruptcy process outweighs the benefit it is providing you.

This question must always be first tempered with the immediate benefit of the “automatic stay” injunction: the moment you file the case, you stop all collections activity. No foreclosures, garnishments, tax levies, property seizures, or even phone-calls can proceed while the Chapter 13 is in process.

This is a benefit that is situationally hard to put a price on.

That said, if you only owe $10,000 in debt, a 5-year Chapter 13 in which you will pay at minimum $3,500 in attorney fees plus a percentage-based fee (per monthly Plan payment) to the Chapter 13 Trustee who administers the Chapter 13 bankruptcy estate is likely not a great deal.

A non-bankruptcy option should be pursued if Chapter 7 is not palatable or available, and a Chapter 13 makes no sense on a “bang for buck” level.

CHAPTER 13 BANKRUPTCY: CAN YOU AFFORD YOUR PARTICULAR PLAN PAYMENT?

A Chapter 13 bankruptcy requires that you make a monthly “Plan payment” to the Chapter 13 Trustee that is, at a minimum, equivalent to the “net monthly income” at the bottom of your Schedule J list of monthly average expenses (discussed above).

If you have $300 per month in post-expense take-home pay, your Chapter 13 Plan payment is—$300.

However, this simple Plan payment amount formulation can be complicated in some cases by 2 considerations unrelated to your monthly expenses: (1) your assets; and (2) your Means Test.

The Liquidation Analysis

With regard to your assets, one benefit of a Chapter 13 bankruptcy over a Chapter 7 is that no assets are ever liquidated.

However, this does not mean that the possession of non-exempt property does not have an unwelcome effect.

This effect is known as the “Liquidation Analysis,” or the “Best Interest of Creditors Test.”

In short, the effect of having assets of value beyond the limits of your statutory exemptions is that you must pay a minimum amount of money equivalent to that “overage” in value to your unsecured creditors through your Chapter 13 Plan.

Unsecured creditors are those that do not hold “collateral” as mortgage holders and vehicle loan lienholders do. They are medical creditors, credit card issuers, personal loan originators or holders, and so on. If you owe your grandmother money when you file your Chapter 13, she is an unsecured creditor of this sort.

Unsecured creditors are paid last after everyone else.

Thus, if you owned a fancy car worth $50,000, you would be required to pay to your unsecured creditors through your Chapter 13 Plan a minimum of $46,000 after the $4,000 automobile exemption is applied to the vehicle in the petition schedules.

That $46,000 would be allotted to last-in-priority unsecured creditors after your attorney’s fees, the Chapter 13 Trustee’s fees, secured creditors’ payments, lease payments, and “priority” unsecured creditors’ payments.

It would require that the monthly Chapter 13 Plan payment be sufficiently large to pay all of these things—regardless of what your actual, real-life income and household expenses happen to be.

The Means Test

The second possible cause of “Plan payment inflation” is the Means Test, which must be fully calculated for Chapter 13 purposes as well as Chapter 7.

When all of the available Means Test gross income deductions are input by your bankruptcy attorney, the Means Test will produce, at the end of the calculation, a number called “Disposable Monthly Income,” or “DMI.”

The Bankruptcy Code requires that your unsecured creditors in a Chapter 13 Payment Plan be paid no less than DMI multiplied by the number of months that your Chapter 13 Plan runs.

Thus, if your Means Test result is that you have $100.00 in DMI and your Chapter 13 Plan is 6 months long, your unsecured creditors must (as a pool) receive a minimum of $6,000 from your Plan after all other higher priority creditors and parties are paid.

Both of these “effects” can result in a Chapter 13 alternate reality in which a debtor is required to pay much more than the debtor can actually afford in terms of real-world income and expenses.

It does not help that the allowed Means Test gross income deductions do not in a great many cases mirror real world household expenses.

CHAPTER 13 VS. CHAPTER 7 BANKRUPTCY: THE BOTTOM LINE

The bottom line is that you need the advice of a highly experienced Michigan bankruptcy attorney to assist you with your bankruptcy filing whether or not you yourself think you have a “simple” case or that you will pass the Means Test “no problem” because you completed an online Means Test calculation form.

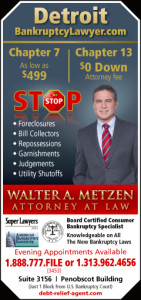

Attorney Walter Metzen has represented thousands of consumers in Chapter 7 and Chapter 13 bankruptcy cases in Michigan. A Board Certified Bankruptcy Expert, Attorney Metzen has dealt with bankruptcy issues for over 28 years.

The Law Offices of Walter A. Metzen & Associates offers free consultations for those interested in the bankruptcy process and is experienced in determining and advising as to the best course of action when filing a Chapter 7 or Chapter 13 bankruptcy in Michigan.

Get a Fresh Start! Contact Attorney Walter Metzen for a FREE consultation!