Contents

Can you blame your bankruptcy lawyer if an asset is left off your bankruptcy petition?

If you disclose all of your assets in your bankruptcy petition so that your attorney can properly advise you, you will avoid having to blame them later because your case should go through the bankruptcy system without a problem.

The short answer is yes, you can blame your lawyer, but ultimately you are responsible for properly listing and disclosing assets in your bankruptcy schedules, so unless your lawyer admits to the omission, you will have to explain why it was missing from your bankruptcy paperwork.

An experienced bankruptcy lawyer will ask you the right questions and reassure you that there is no need to conceal assets during your bankruptcy case. Usually these assets can be protected as part of your fresh start. Tell your attorney everything so that he or she can properly advise you and avoid listening to non-lawyers who may scare you into thinking that you will lose something if you tell your lawyer about it.

In my 30+ years as a Detroit bankruptcy attorney, I have personally witnessed numerous cases in which a bankruptcy trustee uncovered an undisclosed asset during a .341 bankruptcy hearing or meeting of creditors. In the vast majority of these cases, the asset at issue is merely an oversight by either the debtor or their bankruptcy attorney and the trustee is simply pointing it out at the hearing so that an amendment can be filed to properly disclose the asset. If the mistake is due to a simple omission or typo, the attorney will quickly admit it to the trustee and fix it. An example of this might be on bankruptcy schedule B question 6: Wearing Apparel. Given the fact that everyone owns some clothing and if the answer to this question is NONE, the trustee will kindly point out that the answer must be wrong as the debtor is clearly sitting in front of him or her and is not naked. Some bankruptcy attorneys get irritated if a trustee asks them to file an amendment to properly list the debtor’s clothing as there is clearly sufficient exemption to protect the clothing and the trustee really has no interest in it anyhow. While it may seem trivial, for the bankruptcy system to function properly, all assets must be properly disclosed. Bankruptcy trustees want to keep their jobs and have a boss to answer to just like most of us. Bankruptcy cases are subject to routine audits and the trustee has an interest in the petition and schedules to be as accurate as possible as does the debtor. A good bankruptcy lawyer will do what the trustee asks, file the amendment and fix the error.

Undisclosed asset or simple oversight?

The bigger problem arises when there is an actual attempt to conceal an asset and that asset is discovered by the trustee. Fortunately, these cases are relatively uncommon, but nonetheless, they do occur. Intentionally concealing an asset from your bankruptcy paperwork is fraud and is subject to criminal prosecution. How does the trustee find undisclosed assets in bankruptcy? In my discussions with various trustees in Detroit Michigan where I practice, their most common source for finding concealed assets is an ex-spouse or ex-boyfriend or girlfriend. If a trustee discovers an undisclosed asset of significant value and attempts to take it from the debtor and sell it for the benefit creditors, the debtor will often claim that they told their attorney about it and blame their attorney for the mistake. The problem with this argument is that most bankruptcy attorneys are not going to accidentally omit a significant asset from the schedules and if they do, are readily going to admit their mistake to the trustee and quickly make the appropriate corrections. Just like any other working network of professionals, bankruptcy attorneys are known by their reputation. If an attorney has an excellent reputation of accuracy in the preparation of their client’s paperwork, the trustee will know it and placing the blame on this attorney will simply not work. On the other hand, if the debtor’s attorney is known by the local bankruptcy community as one who does sloppy work or simply hands the file off to a legal assistant to process the paperwork without an in-depth consultation, the trustee may be more understanding and give the debtors the benefit of the doubt.

Chapter 7 and Chapter 13 bankruptcy trustees have conducted thousands of section .341 hearings and most have developed a sixth-sense as to when a debtor is being dishonest and attempting to hide an asset.

Why blaming your bankruptcy attorney rarely works as a defense to bankruptcy fraud.

1. Most assets can be protected if properly disclosed to your lawyer.

Most bankruptcy attorneys practice both Chapter 7 and Chapter 13. In Michigan, where I practice, debtors can choose between the federal or the state exemptions. Most exemption laws are quite generous and allow a skilled attorney to exempt or protect the property if the client discloses it to them or to simply pay the value of the asset in a Chapter 13 case. In rare cases, neither can be done and the attorney advises the potential client to simply not file.

2. Bankruptcy petitions are signed under penalty of perjury.

You sign your bankruptcy petition under penalty of perjury that you have disclosed all of your assets in your paperwork.

You are signing the bankruptcy petition in multiple places indicating that you have read it and that it is completely truthful and accurate and are doing so under penalty of perjury. Furthermore, all bankruptcy attorneys are required by law to give their clients certain disclosures shortly after meeting with them, one of which is a notice that:

“A person who knowingly and fraudulently conceals assets or makes a false oath or statement under penalty of perjury, either orally or in writing, in connection with a bankruptcy case is subject to a fine, imprisonment, or both.”

3. Bankruptcy attorneys will not risk the loss of their law license and possible court sanctions to assist a debtor in perpetrating a fraud upon the bankruptcy court.

Attorneys spend years and hundreds of thousands of dollars to achieve their law license and the vast majority of bankruptcy attorneys would never consider risking the loss of this license or Rule 9011 sanctions by assisting a debtor in an attempt to conceal an asset from the proper administration of a bankruptcy case. (see In re: STELLA ANNA OPRA )

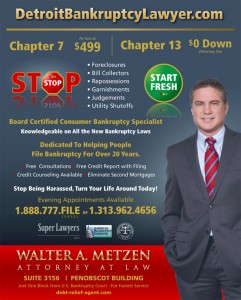

Michigan Bankruptcy Attorney Walter Metzen is a board certified consumer bankruptcy attorney practicing in the Detroit bankruptcy court.